Manage All of Your Business Payments with One Platform

Technoboot allows you to

- Connecting all of your bank accounts in one location will help you better manage your cash flow.

- Instantaneously pay employees and vendors

- Send GST-compliant e-invoices and receive consumer payments

- Automated payment reconciliation can save you time.

- Make payroll and spend management simpler.

Features

General Ledger

Maintain a detailed record of every financial transaction, offering a snapshot of your company's financial health and facilitating informed decision-making.

Accounts Payable

Effortlessly handle payments to vendors and suppliers, ensuring timely transactions and preventing unnecessary late fees.

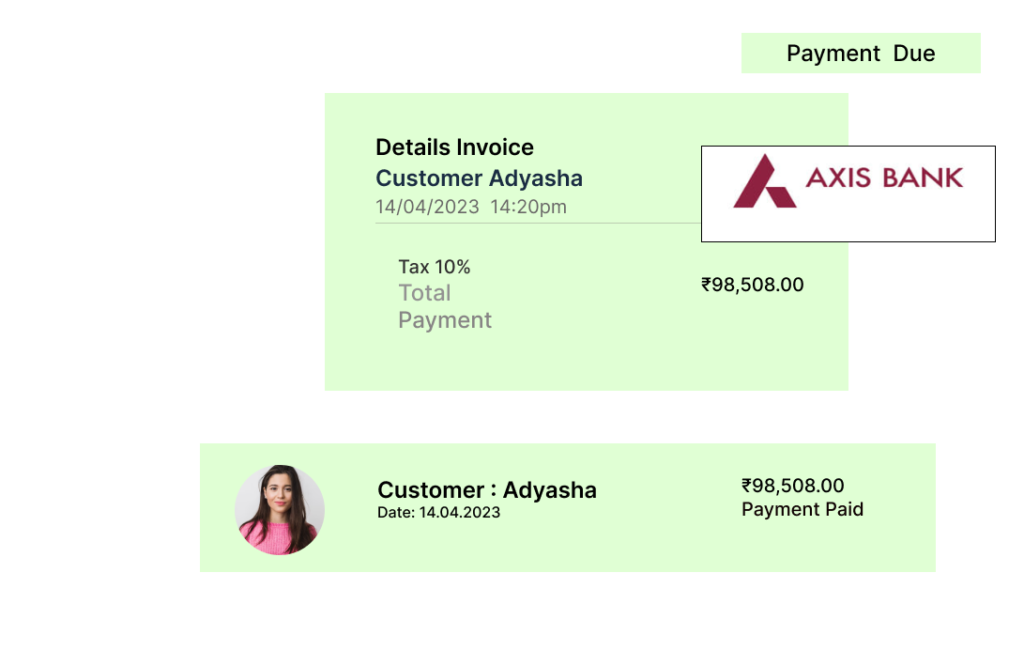

Accounts Receivable

Keep a close eye on outstanding payments from customers, enhancing cash flow management and optimizing your business finances.

Invoicing

Streamline the billing process by generating professional invoices, tracking payment statuses, and simplifying your overall billing cycle.

Bank Reconciliation

Ensure the accuracy of your financial records by reconciling transactions recorded in the accounting software with your bank statements, promptly identifying any discrepancies.

Financial Reporting

Access comprehensive financial reports such as income statements and balance sheets, gaining valuable insights into your business's financial performance for strategic planning.

Expense Tracking

Effectively monitor and categorize business expenses, aiding in budgeting, cost control, and maintaining financial transparency.

Payroll Management

Simplify payroll processes by calculating and managing employee salaries, taxes, and deductions, ensuring compliance with regulatory requirements.

Why Opt for Technoboot?

Management of Connected BankingQuick Payouts

Management of Payroll

Reconciliation via Automate

Use Technoboot Money to Automate Payments at a Higher Level

- 80% fewer duties related to manual payments

- An average of 500 hours are saved with automatic reconciliation.

- 25% less work is required for manual reconciliation.

Pay Workers and Vendors

- With linked banking, you can handle payroll, pay suppliers with a single click, and keep an eye on your cash flow in real time.

- Using a straightforward CSV file upload, you may schedule large payments to suppliers or employee salaries.

- Process safe payments to suppliers and staff instantly via IMPS, UPI, NEFT, or RTGS transfers.

- Prevent beneficiary wait times, lessen administrative burdens, and guarantee accurate disbursements.

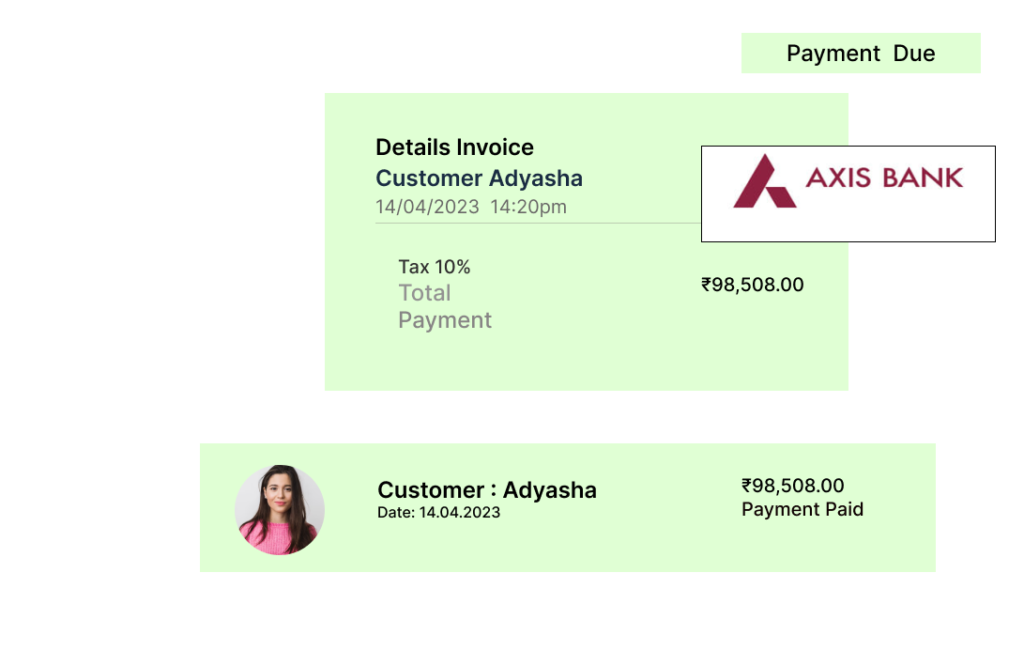

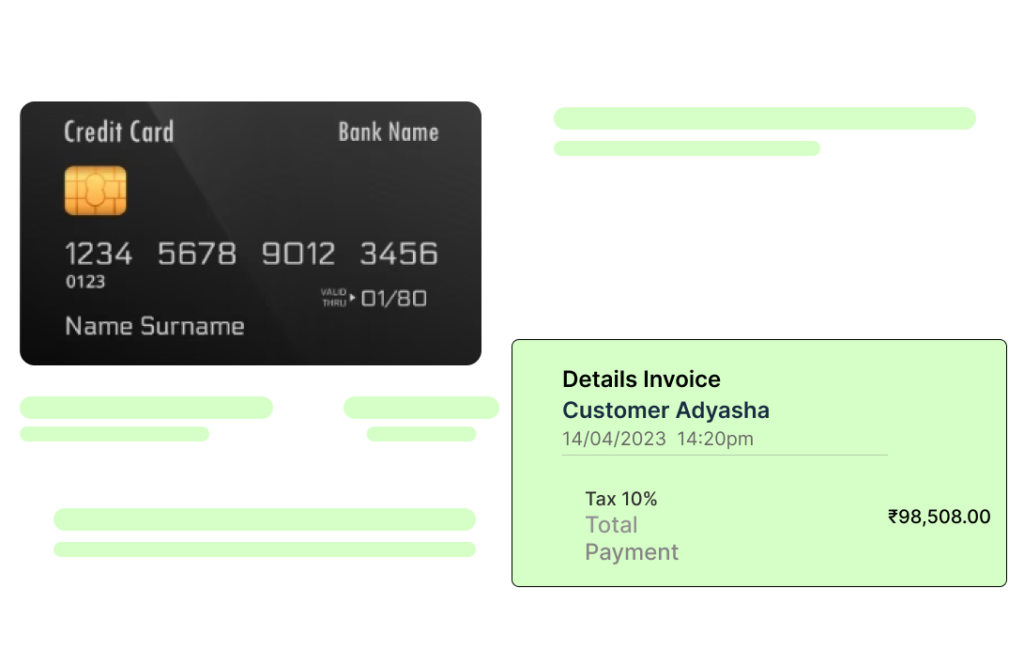

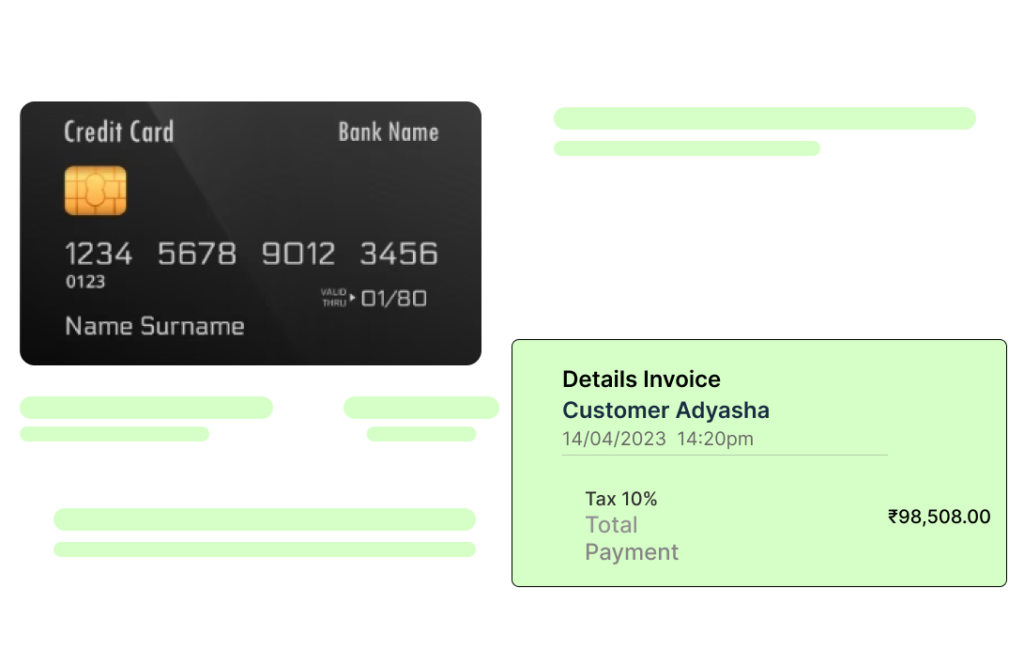

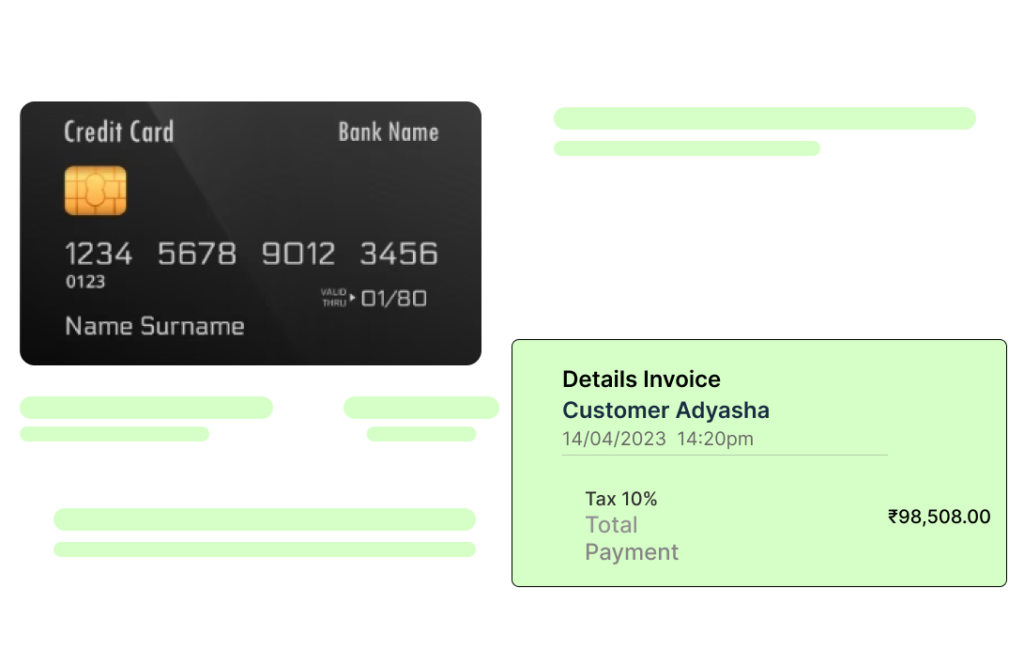

Retrieve Payments from Clients

- Provide consumers with invoices that are GST-compliant and provide payment links to facilitate their online payments.

- Offer a variety of online payment options to your clients, such as credit cards, UPI, and bank transfers.

- Efficiently import invoices from your accounting software and automatically reconcile payments to minimize manual labor.

- Link your website's checkout page to Technoboot's reasonably priced and dependable payment gateway to begin receiving payments from your clients.

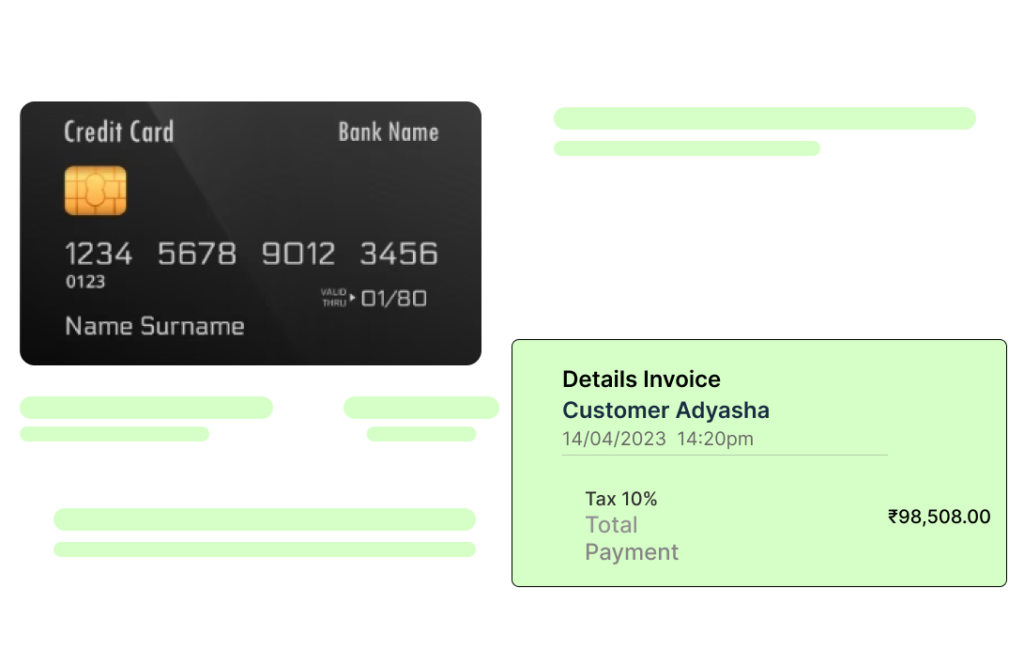

Streamline the Spending Process

- Get a unified overview of all out-of-pocket, cash, and credit card business expenses.

- Track spending in real time at many levels, including the individual, team, and budget.

- Give your staff more power with virtual and Visa-powered cards. Establish spending guidelines and load money quickly.

- Pay employees' out-of-pocket costs straight from the linked bank accounts.

Eliminate All Manual Labor. Utilize Automated

Reconciliation to Save Time

payments, and integrates smoothly with your accounting program.